All investments carry threat, and no investment tactic can ensure a earnings or safeguard from lack of funds.

d) Partial withdrawals expressed being a percentage in the Fund Worth at time of partial withdrawal are permitted only three times over the overall term on the coverage.

According to the prevailing norms underneath the Income Tax Act, 1961 $ $You could be suitable for Earnings Tax Added benefits According to the applicable profits tax regulations in India, which are issue to vary on occasion.

The prepare offers you liquidity in the event of any will need. You can decide to help make a partial withdrawal once the 5th policy 12 months or on attainment of age 18 many years by the lifetime assured whichever is later.

By using this Web page, you recognize that the information remaining offered is delivered for informational uses only and agree to our Conditions of Use and Privacy Coverage. Content articles and shopper guidance components available on this Internet site are for instructional functions only.

Pay out rates for Limited phrase or as Solitary Payment, According to your comfort and enjoy Positive aspects throughout the policy term. Two protection choices :

On death of your Policyholder whilst the daily life certain is usually a minor, no instant advantage might be payable. The plan can be ongoing because of the appointment of a different Policyholder with the coverage.

It is best to consider all of the factors that should be evaluated inside a rollover determination together with investment solutions, costs, expenditures, penalties and account protections from lawful and creditor dangers, and generate a comparison for your present-day retirement account. You must talk to with all your very own monetary and tax advisor before making a rollover choice.

The data contained on this Web site isn't supposed as, and shall not be comprehended or construed as, tax tips. It isn't a substitute for tax suggestions from knowledgeable.

* A non-smoker wholesome male of 22 a long time, Investment of ₹2500 every month less than Advancement Plan option, twenty years plan expression enjoys maturity advantage of ₹.7.68 lacs (@assumed rate of return four%)^^ & ₹. eleven.85 lac (@assumed fee of return 8%)^^. Bare minimum every month quality amount permitted to begin your insurance plan system. Expansion & Wealth preservation services Well balanced are based upon Over-all exposure to equity, debt and money market devices through policy time period. Tax Gains are as per Revenue Tax Guidelines & are subject matter to alter every so often. Please speak to your Tax advisor for information. Fund Value figures are for illustrative applications & for nutritious existence. Make sure you Observe that the above described assumed prices of returns @4% and @eight% p. a., are only illustrative eventualities, soon after thinking about all applicable charges. These are typically not assured and they're not higher or decrease boundaries of returns. Device Joined Lifestyle Insurance plan products are matter to market threats. The varied resources offered under this contract are classified as the names of your cash and do not in any way show the quality of these designs as well as their foreseeable future prospects orreturns. For more info, request on your coverage unique reward illustration. Device Linked Lifetime Insurance policies products are diverse from the normal products and solutions and they are issue to sector threats.The top quality paid in Unit Connected Insurance policies are issue to investment threats associated with cash marketplaces along with the NAVs in the models may perhaps go up or down based upon the effectiveness of fund and components influencing the money market and also the insured is responsible for his/her decisions.

On diagnosis of everyday living assured with a terminal ailment over the policy term or in advance of attainment of 80 decades, whichever is before, the terminal illness gain could well be payable. The benefit equivalent to sum assured on Demise as on date of prognosis, issue to highest of Rs.

For additional aspects to the ways to utilise the maturity reward refer the gross sales literature. Dying gain.

The Important Illness Reward is payable only soon after survival of 14 days within the day of diagnosis of the protected essential illness.

SBI Existence- Wise Champ Insurance plan Approach presents confirmed wise Advantages which can help go over your child’s educational needs. These benefits are payable in four equal annual instalments once the boy or girl attains eighteen several years of age till the kid turns 21 decades of age, i.e. at the conclusion of Just about every of very last 4 policy many years. 1st installment, 2nd installment, 3rd installment and final installment of Sensible Added benefits are payable at the conclusion of the coverage 12 months during which the child completes 18, 19, twenty and 21 years of age respectively. Every installment of Intelligent Advantages will consist of twenty five% of The fundamental sum assured and twenty five% of your vested very simple reversionary bonuses, if declared. Terminal reward, if declared, will likely be compensated along with the previous installment of Good Rewards.

Reach new heights with self-assurance. Your aspirations travel you to achieve the top and more in life. SBI Lifetime - Sensible Elite is a person, Device- Joined, Non-Collaborating, visit this web-site Daily life Insurance policy item that lets you get a lot more from a economic investments so that you can delight in the freedom of accomplishing your dreams as a result of industry joined returns and secure beloved a person’s future.

Smart Selection Approach - With the Lively Trader who wants larger expansion more than a interval. It also provides fund switching and quality redirection attributes. Versatility to change the investment approach

Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Melissa Joan Hart Then & Now!

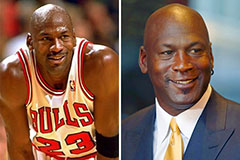

Melissa Joan Hart Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!